ev tax credit 2022 retroactive

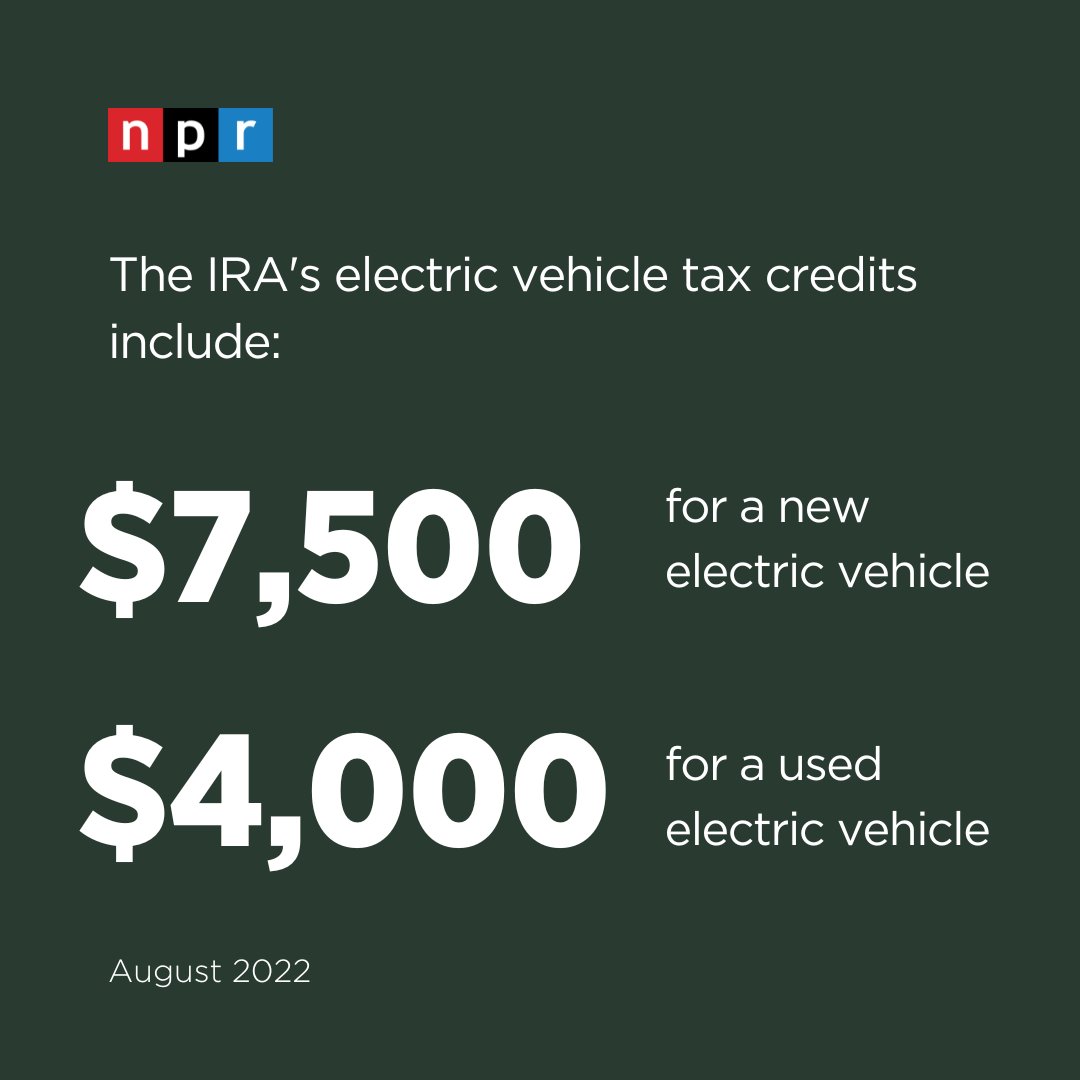

First and foremost for EVs placed into service after December 31 2022 the Inflation Reduction Act extends the up to 7500 EV tax credit for 10. Updated September 2022.

Climate Bill Would Create Roadblock For Full Ev Tax Credit E E News

What Is the Electric Vehicle EV Tax Credit.

. The main thing that should. Consumers who buy a new electric vehicle can get a tax credit worth up to 7500. US congressional leaders have agreed to a bill that would expand the existing 7500 new EV tax credit while introducing the first federal tax credit for used EVs.

Used vehicles qualify for up to 4000. Major revisions to the EV tax credit were signed into law as part of the Inflation Reduction Act of 2022. Taxpayers are eligible for a credit of 30 of the hardware and installation costs for EV chargers installed in their homes after December 31 2021.

Heres what you need to know about the latest. The credit amount will vary based on the capacity of the. And the OEM phaseout is retroactive to May 24 2021 so buyers of Tesla and GM EVs purchased after May 24 2021 could apply the credit on their 2021 tax return.

The EV tax credit proposed by Biden and other Democrats would be an increase from the current 7500 credit to a maximum of 12500. However only specific types of. The new credit applies to electric vehicles delivered after December 31 2022 meaning delivered in 2023.

Since the US added EV tax. EV Tax Credit Expansion. Clearly this is intended to favor union shops and force Tesla and other EV makers like Lucid and Rivian to have union shops.

Note that this list is not written in stone and will change with the phase-in of other. If you are interested in claiming the tax credit available under section 30D EV. This is a one-time.

Used clean vehicles will now be eligible for a credit of up to 40. How the EV tax credits in Democrats climate bill could hurt electric vehicle sales Published Wed Aug 10 2022 1055 AM EDT Updated Wed Aug 10 2022 309 PM EDT Michael. First off the incentive is not retroactive.

Based on how the federal EV tax credit currently works it is not a retroactive incentive and must be claimed on tax forms for the year in which you purchased your EV. But there are caveats here. Jeep Wrangler PHEV.

Lets back up for some context. All-electric and plug-in hybrid cars purchased new in or after 2010 may be eligible for a federal income tax credit of up to 7500. For 2021 taxes filed in 2022 the fully refundable Child Tax Credit is 3000 for children under age 18 and 3600 for children.

Volkswagen cannot guarantee that its ID4 compact electric SUV will be eligible for the new electric vehicle tax credits that are set to go into effect after President Joe Biden. Under the bill buyers of previously-owned electric vehicles would be eligible for a 4000 credit or 30 off the cost of the vehicle whichever is less. The enhanced residential clean energy credit is.

Updated information for consumers as of August 16 2022 New Final Assembly Requirement. In 2010 the federal government. With the recent breaking news about EV tax credits included in the Inflation Reduction Act of 2022 there has been a lot of misinformation spreading on socia.

Vehicles made in union shops would have a tax credit of 125K. They have previously been excluded from any form of the EV tax credit but will now be eligible for partial credit. No the Toyota RAV4 Prime is no longer eligible for any federal tax credits from the IRS as of August 16 2022.

The New Ev Tax Credit In 2022 Everything You Need To Know Updated Yaa

Ev Tax Credit Boost At Up To 12 500 Here S How The Two Versions Compare

Buy Now To Claim The 7 500 Federal Ev Tax Credit Before It Expires For 2022

Ev Charging Tax Credit Integrated Building Systems

Buy Now To Claim The 7 500 Federal Ev Tax Credit Before It Expires For 2022

3 Ways The Inflation Reduction Act Would Pay You To Help Fight Climate Change Twitter

![]()

Latest Ev Tax Credit Status Tesla Motors Club

Ev Tax Credit What It Means For Car Buyers And The U S Auto Industry

Gm Issues Retroactive Discount For Chevy Bolt Ev Models Bought New In 2022

Understanding The Electric Vehicle Credit Strategic Finance

New Solar Tax Credit Explained Texas Direct Solar

Ev Tax Credit 2022 Changes How It Works Eligible Vehicles Carsdirect

What New Pay Transparency Laws Could Mean For U S Workers Forbes Advisor

How Does The Electric Car Tax Credit Work U S News

The New Ev Tax Credit In 2022 Everything You Need To Know Updated Yaa

Elon Musk Talks Tesla Doe Loan Ev Tax Credit More In Part 2 Of Tesla Owners Of Silicon Valley Interview Cleantechnica

Federal Tax Credit For Ev Charging Stations Installation Extended

.png)